5 Strategy Matrices All Entrepreneurs Should Know

Dec 21, 2020

For many people, the only matrix worth knowing includes Keanu Reeves but they’d be missing out on great tools to navigate the complex world of running a business.

It takes passion to start a company but this same fire can blind entrepreneurs to the bigger picture. They can’t see problems obvious to outsiders because they are so focused on their vision. Management consultants have made a $250bn industry out of pointing these white elephants out.

Yet you don’t need to spend money on expensive consultants to make use of their simple matrices. They are widely published and taught at business schools across the world. A matrix is just a grid used to categorize companies and tasks to make sure the appropriate strategy is taken. Using a matrix won’t magically make you a billionaire but it could save you a lot of wasted time.

I’m covering 5 of the most trusted matrices used in the strategy consulting industry:

- BCG Matrix

- Ansoff Matrix

- GE-McKinsey 9 Box Matrix

- SWOT Matrix

- Eisenhower Matrix

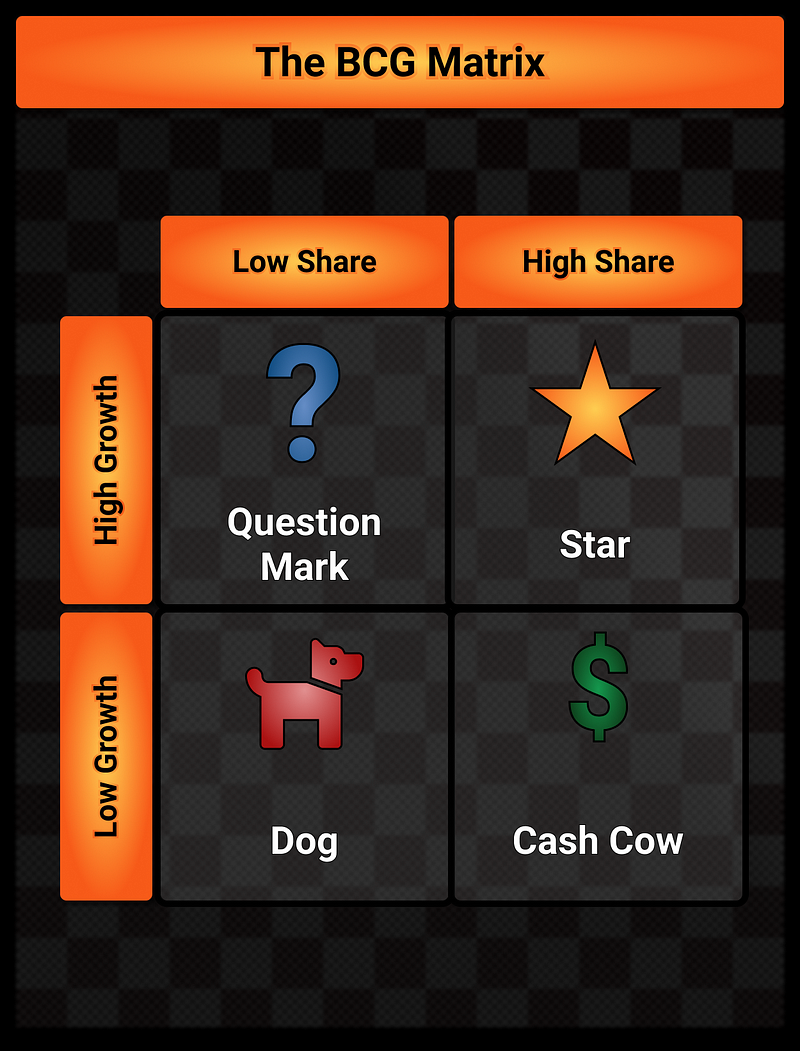

The Boston Consulting Group (BCG) has powered the growth of many of the world’s largest companies. In the 1970s, they created their devilishly simple growth-matrix. By using memorable characters for each square, it’s become a mainstay for 50 years. The primary function is to remind you to focus on the areas which are growing fast and dominating.

On the Y-axis is the growth rate of the market and on the X-axis is the company’s market share. Different strategies should be used depending on which square you are in. If you haven’t started a company yet think about companies and divisions of companies that interest you. Most likely these will be the stars and the dogs will mainly be in the bankruptcy section.

- Question mark — Being in this quadrant is a perplexing place to be. If the market is growing fast, why don’t you have a bigger share? You need to strategize carefully here and decide whether or not you can increase your market share to capture the growth. When you are losing out to the competitors, it might be better to call it quits.

- Star — Everybody thinks their company is a star but most of them are wrong. The star companies are what venture capitalists dream about at night and why they are willing to pump money into early-stage companies. When it works (think Uber and Airbnb), the value generated is colossal. If you have an idea that can dominate a high-growth industry then invest, invest, invest!

- Dog — Nothing screams dead end more than a low share of a low growth industry. For some time you might keep going but the dominant players will muscle you out eventually. It’s best to divest these ideas and focus on the stars and cash cows.

- Cash cow — The perfect place to be after building your company up to reduce your stress. Once you can dominate a mature industry, your concern is keeping your market share high and reaping the rewards. If it’s too early for retirement, you can funnel the profits into new potential stars. Think of Coca-Cola as a great example, the core product is mature so they use the profit to invest in other products.

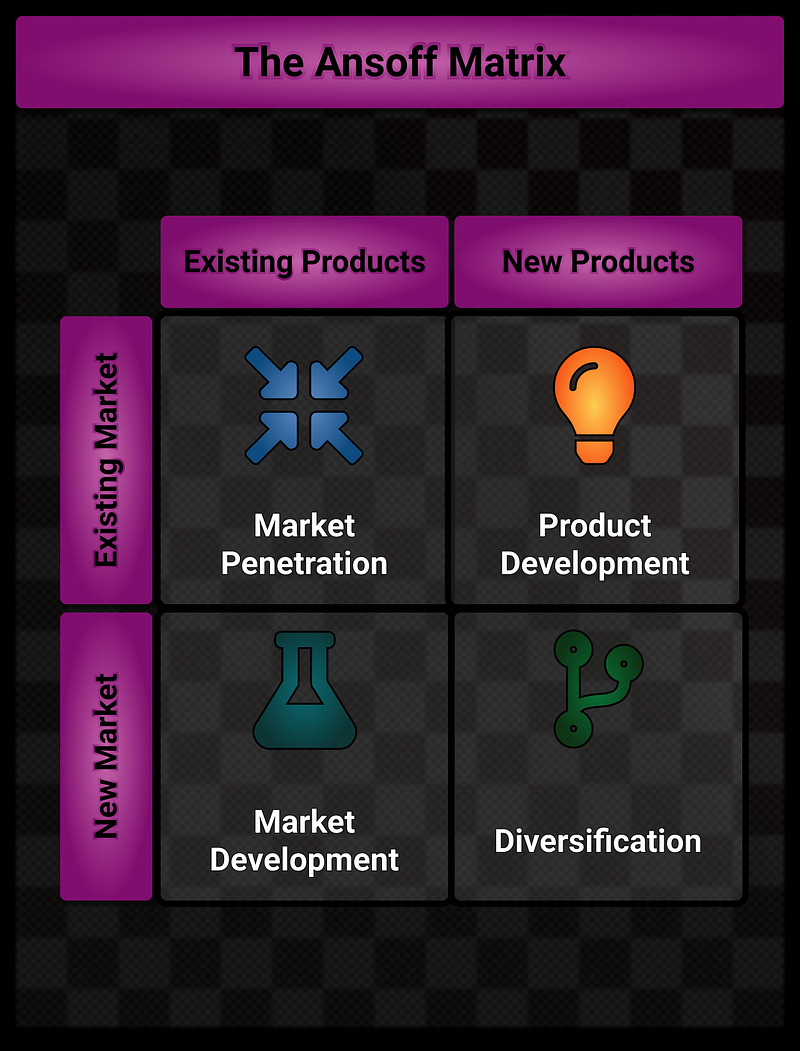

Igor Ansoff is known as the father of strategic management. Over his career, he was critical in the foundation of several management schools as well as advising over a hundred companies. His work inspired much of the industry to create the kinds of generic frameworks you see here.

His matrix, the Ansoff matrix, is about correctly defining your growth path. The Y-axis represents whether the market is established already and the X-axis is whether the product exists. The risk increases as you move from the top left to the bottom right. Too often you see companies trying to penetrate their market but being distracted by tactics from the other parts of the matrix.

- Market penetration — This path isn’t what we’d traditionally consider a startup, it’s not so much about revolution as tactical warfare to increase market share. Options available include decreasing prices, increasing promotion, or acquisitions.

- Market development — Truly great companies have taken products that are successful in one segment and widened their audience through clever marketing. Take Facebook which started aimed at college students and kept bringing in new demographics until it took over the world.

- Product development — Google is an expert at product development. Through their search engine, all internet users were their market but they increased reliance through tools such as Google Maps and the G-Suite of office features.

- Diversification — This is the entrepreneur’s dream, targeting a new market with a totally new product which makes it the riskiest strategy. Berkshire Hathaway is a great example where they keep adding different industries to their portfolio rather than stick to one market or product they know well.

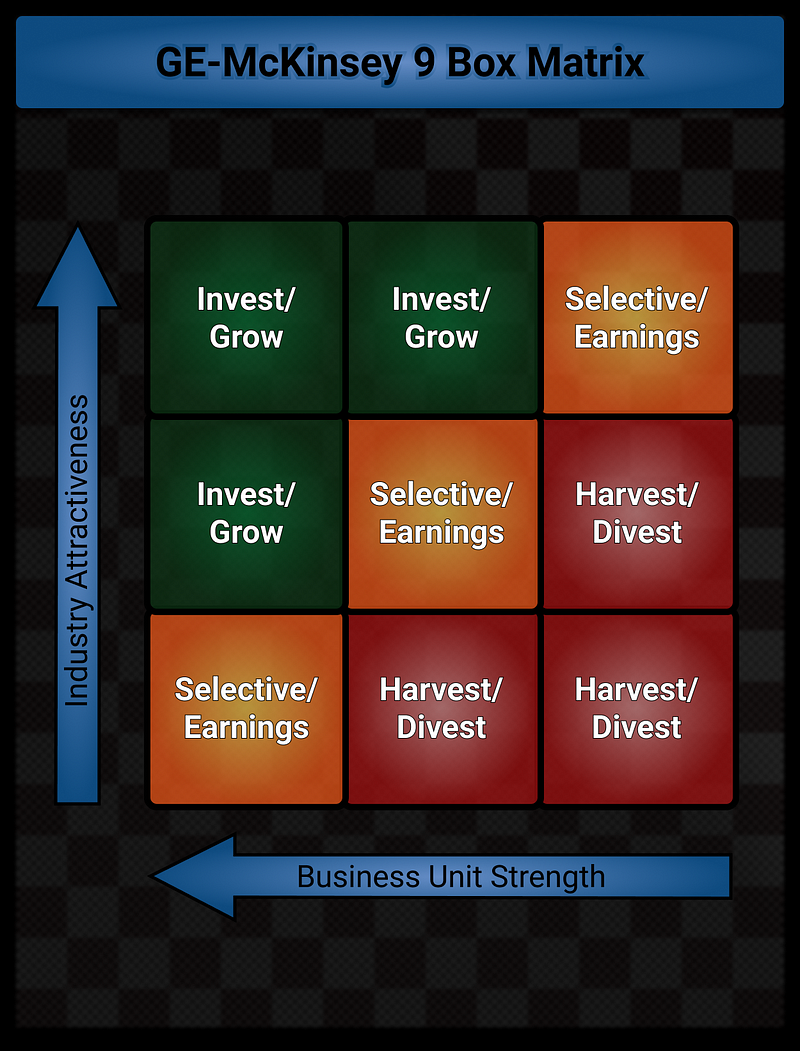

Like BCG, McKinsey is one of the world’s leading consulting firms. General Electric also shouldn’t need any introduction as a mainstay of the Dow Jones list of largest industrial companies in the USA. In the 1970s, McKinsey was working with GE to understand their unruly kaleidoscope of different businesses.

GE needed to make tough decisions to avoid being swamped but was bombarded with irrelevant statistics. McKinsey simplified the process by focusing on two key metrics: business unit strength and industry attractiveness.

This matrix is especially relevant for companies with multiple products so entrepreneurs can decide where to focus their efforts. As we go up in the matrix, the industry attractiveness increases. Unintuitively, they decided to make the business unit strength go backward so the further left of the grid, the stronger the business unit.

Depending on where the business unit ended up there were 3 choices:

- Divest/harvest — When you aren’t strong in an undesirable industry, it’s time to exit unless it’s still bringing in some profits. These areas should never be invested in when there are other options available.

- Selective/earnings — As in the traffic light system, these are the proceed with caution units. They need to be monitored the most carefully to see if they start veering towards the invest or divest sides. If you decide not to invest more, you can still use these areas as short-term plays for income to fund other areas of the business.

- Invest/grow — These are the fantasies when you are doing well in an attractive industry. These should be the focus of the company and where your investment is concentrated.

This is the classic matrix most people will first think of but it’s still relevant today. It’s easy to fall into the trap of unicorns and rainbows early on but paying attention to threats and weaknesses can bring some home truths. It’s worth completing this yourself and then asking others to do the same exercise for your business. You may find what you thought you knew about your business isn’t a shared opinion.

- Strengths — The bit you’ll love to fill out. What makes your company special and what are you good at.

- Weaknesses — Be honest here, there's no point in pretending your company is the best at everything. You have two choices: either accept your weaknesses and narrow your focus or fight them tooth and nail to broaden your appeal.

- Opportunities — What are your competitors weak at? What needs do customers have that no one is fulfilling? It’s worth thinking about wider trends here. For example, the massive shift to working from home was an opportunity Hopin seized and Slack was lackluster.

- Threats — What are your competitors good at and getting better at relative to you? Again the focus should be external. The tech industry needs to pay particular attention to regulations around privacy. The potential for further policies like GDPR could make business conditions more difficult in the future.

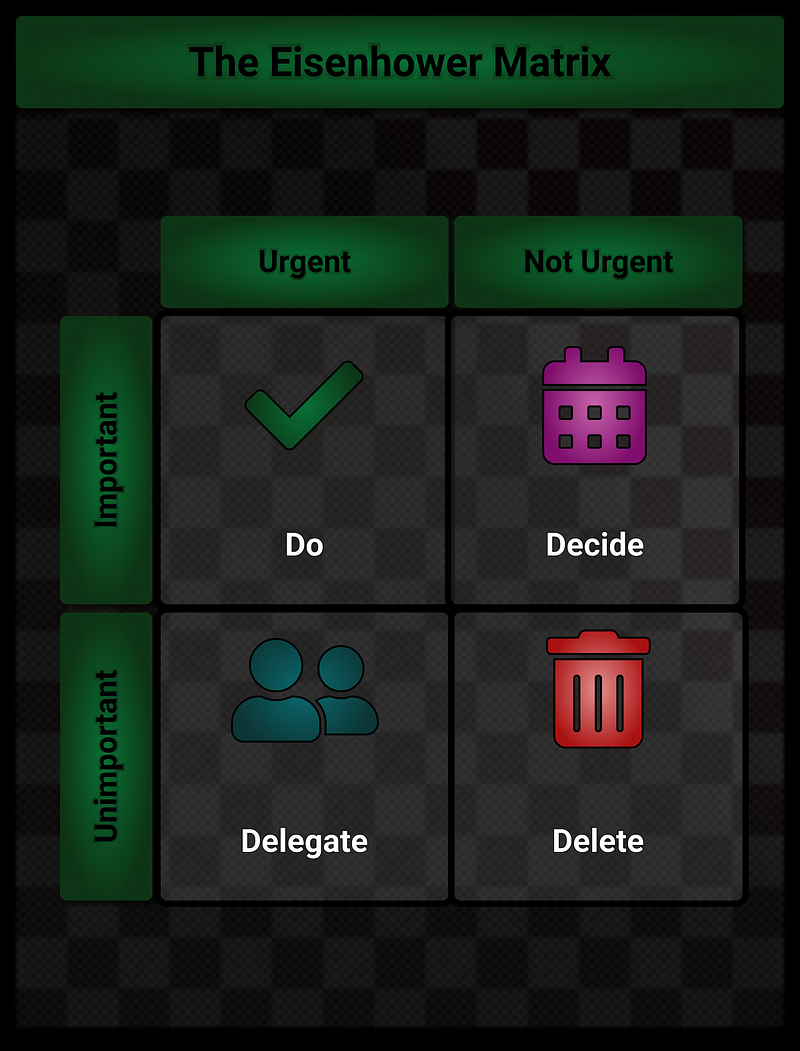

Effective time management is one of the toughest skills for entrepreneurs as all kinds of tasks are thrown their way. The curse of many is believing only they can do something in a way that is acceptable which leads to a short road to burnout. Focusing on the high-value tasks protects your mental wellbeing and leads to the best outcomes for your business.

This matrix was created by the 34th President of the United States, Dwight D. Eisenhower who as you can imagine had many competing tasks in 1953. While his legacy is outshone by his successor, John F. Kennedy, his matrix lives on and is still taught in workshops across the corporate world.

- Do — If there is something important and urgent to do then forget the rest of the list and get this down ASAP. The last day for tax returns is not the time to be dallying about.

- Delegate — This is the hardest task for many entrepreneurs who feel only they can do something well. By taking too much on, you burn yourself out for the important tasks. Learn to delegate.

- Decide — Important tasks that aren’t urgent are usually forgotten. Get around this by scheduling time in advance to get onto it and only an important and urgent task can delay this.

- Delete — If something is not urgent or important, why is it even being done? Some say if it takes under 2 minutes to do it but this doesn’t account for switching costs and the cumulative effect. Be brutal.

This is an introduction to the 5 matrices, there is plenty more information out there if you want to use one in-depth with your own company. Test out the tools once with your business and see which matrix triggers the most questions in your mind. The objective here is to challenge your status quo mindset and this might be a bit uncomfortable. Good luck and I hope this will help you plan!